尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

A lot was happening in markets when Covid-19 shut down the world in March 2020. One of the most noted happenings was how the price of many fixed-income ETFs became unmoored from the value of the bonds they contained.

2020年3月,当新冠疫情关闭世界时,市场上发生了很多事情。其中最引人关注的是许多固定收益ETF的价格是如何脱离其所含债券的价值的。

It seemed like vindication for people like Carl Icahn and Michael Burry, who had warned that ETFs had become so big that they were dangerous — especially in less traded markets like bonds. Finally, the illusory liquidity of the ETFs had collided with the harsh reality of the illiquid assets they held!

这似乎是对卡尔•伊坎(Carl Icahn)和迈克尔•伯里(Michael Burry)这样的人的平反,他们曾经警告说,ETF已经变得如此庞大,以至于非常危险——尤其是在债券等交易量较少的市场。最终,ETF虚幻的流动性与它们所持有的流动性较差的资产的严酷现实发生了碰撞!

However, an

interesting paper from Anna Helmke of the University of Pennsylvania’s Wharton School takes the other side, arguing that ETFs are actually a

better fit for illiquid asset classes.

然而,宾夕法尼亚大学沃顿商学院的安娜•赫尔姆克(Anna Helmke)发表的一篇有趣的论文持相反观点,认为ETF实际上更适合流动性较差的资产类别。

ETFs may be more suited for less liquid index market segments favored by long-term investors, whereas MFs may be a better fit in liquid fund market segments favored by investors with short-term liquidity needs, such as money market funds. Both funds are virtually perfect substitutes in highly liquid market segments, such as large-cap domestic equities.

ETF可能更适合长期投资者青睐的流动性较低的指数细分市场,而共同基金可能更适合有短期流动性需求的投资者青睐的流动基金细分市场,如货币市场基金。在高流动性的细分市场,如国内大盘股,这两种基金几乎是完美的替代品。

Full disclosure: I am particularly keen on this paper because it corroborates something that has been my cautious view

since at least April 2020. And despite the often

-cough- robust feedback since then, I’ve become increasingly convinced this is right.

充分披露:我对这篇论文特别感兴趣,因为它证实了我至少从2020年4月以来一直坚持的谨慎观点。尽管从那以后经常有强烈的反馈,但我越来越相信这是正确的。

Here’s the basic argument: Traditional mutual funds guarantee investors that they will be able to redeem their money in cash at the fund’s end-of-day net asset value — the NAV. Most of the time that works fine, and as Helmke points out, that commitment is quite valuable to a lot of investors that don’t need intraday liquidity.

基本论点如下: 传统的共同基金向投资者保证,他们可以按照基金的日终资产净值以现金赎回资金。大多数情况下,这种方式运作良好,正如赫尔姆克所指出的,对于很多不需要日内流动性的投资者来说,这种承诺非常有价值。

But in times of serious stress, bond market liquidity often gums up. Bond funds therefore tend to sell their best, most liquid bonds first to meet a rush of redemptions (because these will sell at the lowest discount). That leaves a less liquid, junkier fund for the investors who remain.

但在压力严重的时候,债券市场的流动性往往会出现问题。因此,债券基金倾向于首先出售其最好、流动性最强的债券,以应对赎回潮(因为这些债券将以最低折扣出售)。这样就给留下来的投资者留下一只流动性较差的更垃圾的基金。

That’s obviously not attractive, so there’s an inherent bank-run dynamic at play. Investors have a strong incentive to get out as fast as possible to avoid getting penalised financially — or in extremis getting stuck if the fund depletes all its easily sellable assets and is forced to gate.

As the IMF said in 2022:

这显然没有吸引力,所以有一种内在的银行挤兑动力在起作用。投资者有强烈的动机尽快退出,以避免在财务上受到惩罚——或者在极端情况下,如果基金耗尽了所有易于出售的资产,被迫停止赎回,就会陷入困境。正如国际货币基金组织在2022年所说:

Investors can sell shares daily at a price set at the end of each trading session, but it may take fund managers several days to sell assets to meet these redemptions, especially when financial markets are volatile.

Such liquidity mismatch can be a big problem for fund managers during periods of outflows because the price paid to investors may not fully reflect all trading costs associated with the assets they sold. Instead, the remaining investors bear those costs, creating an incentive for redeeming shares before others do, which may lead to outflow pressures if market sentiment dims.

Pressures from these investor runs could force funds to sell assets quickly, which would further depress valuations. That in turn would amplify the impact of the initial shock and potentially undermine the stability of the financial system.

投资者可以每天以每个交易日结束时设定的价格出售股票,但基金经理可能需要几天时间才能出售资产以满足这些赎回,尤其是在金融市场动荡的时候。

在资金外流期间,这种流动性错配可能是基金经理的一个大问题,因为支付给投资者的价格可能无法完全反映与他们出售的资产相关的所有交易成本。相反,剩下的投资者要承担这些成本,从而刺激他们抢先赎回股票,如果市场情绪低迷,这可能会导致资金外流压力。

这些投资者挤兑带来的压力可能会迫使基金迅速出售资产,这将进一步压低估值。这反过来又会放大最初冲击的影响,并可能破坏金融体系的稳定。

In contrast, ETFs trade like shares on an exchange. In the background, their shares are being constantly created and redeemed by specialist ETF market-makers known as “authorised participants” to match supply and demand. Because if the stock price drifts away from the value of the bonds the ETF contain, it opens up a lucrative arbitrage for APs.

相比之下,ETF的交易方式就像交易所的股票一样。在后台,被称为“授权参与者”的专业ETF做市商不断创造和赎回其股票,以匹配供需。因为如果股票价格偏离ETF所含债券的价值,就会给授权参与者带来利润丰厚的套利机会。

When the ETF price is higher than the NAV they can buy bonds that match the index and exchange them for new shares in the ETF. If the price falls below the NAV of the underlying bonds, they can redeem the shares for a basket of the underlying bonds and then sell them. Most of the time this arbitrage keeps ETFs closely tied to their indices.

当ETF价格高于资产净值时,他们可以购买与指数匹配的债券,并将其兑换成ETF中的新股票。如果价格低于标的债券的资产净值,他们可以用股票赎回一篮子标的债券,然后出售。大多数时候,这种套利使ETF与其指数紧密相连。

However, when the bond market freezes, the arbitrage breaks down. APs can’t sell the bonds. So they slow or stop redeeming shares in kind, even when the price of the freely-traded ETFs shares and the NAV diverge.

然而,当债券市场冻结时,套利就会瓦解。AP无法出售债券。因此,即使自由交易的ETF股票价格与资产净值出现背离,它们也会放缓或停止以实物形式赎回股票。

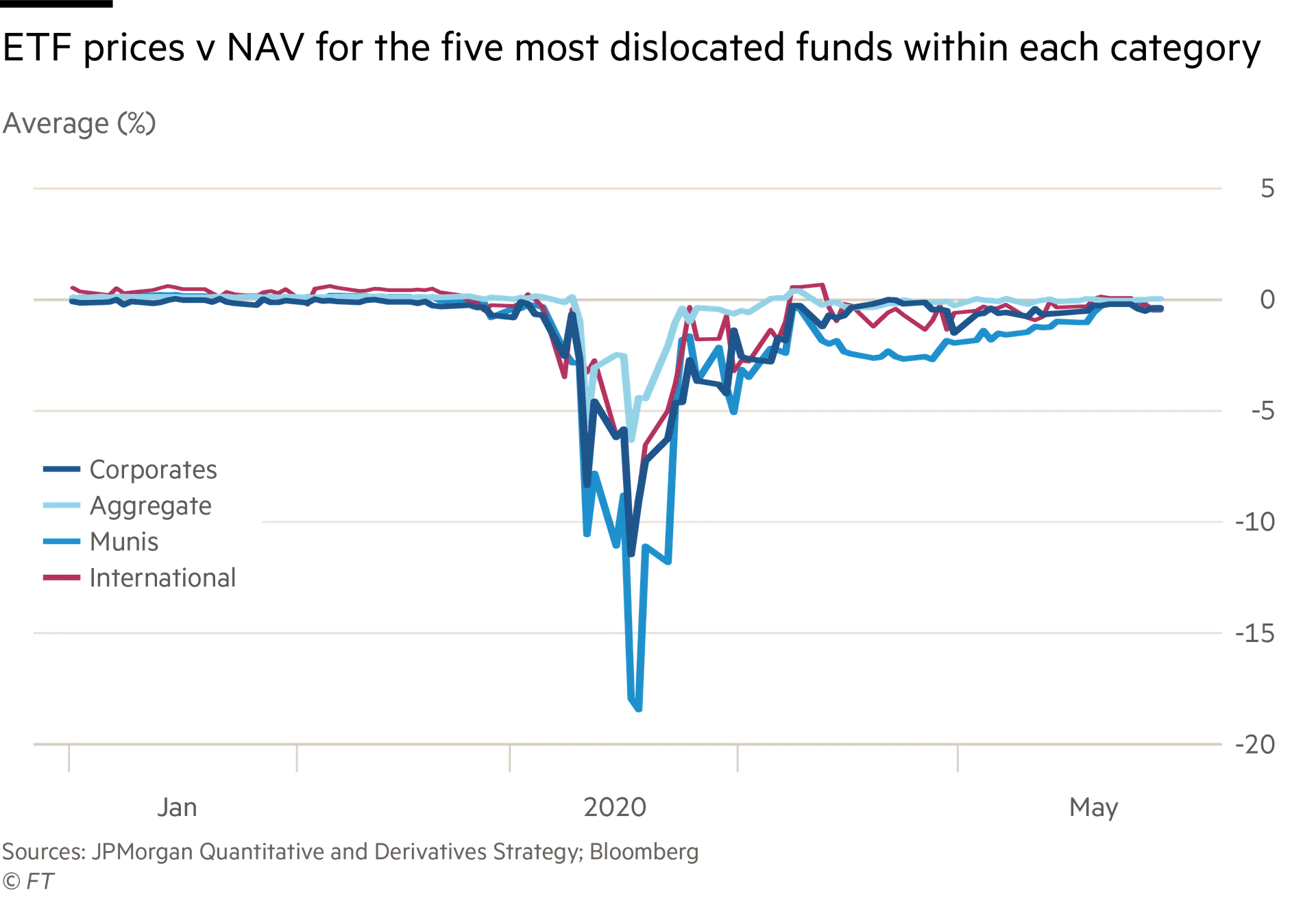

And in March 2020 the dislocation was wild, as you can see below:

2020年3月的错配非常严重,如下图所示:

However, this is a good thing.

然而,这是一件好事。

In essence, the secondary market trading of ETF shares acts almost like a pressure release valve when the underlying bond market seizes up. At a time when you couldn’t sell a swath of the fixed income markets, even at the peak of the turmoil, investors who needed to raise cash in a hurry could always ditch bond ETF shares. The NAVs were stale and misleading, because of the lack of underlying trading, while ETFs plummeted in value.

从本质上讲,当基础债券市场陷入困境时,ETF股票的二级市场交易几乎就像一个压力释放阀。当你无法出售大量固定收益市场时,即使在动荡的高峰期,而需要迅速筹集现金的投资者总是可以随时抛售债券ETF股票。由于缺乏基础交易,NAV变得过时且具有误导性,而ETF价值暴跌。

But most importantly — from a systemic risk point of view at least — the incentives are better than they are for traditional bond mutual funds. With ETFs, exiting investors are penalised (they sell at the discounted market price, not the NAV). With bond funds, remaining investors are penalised (because they are usually stuck in a junkier less liquid vehicle).

但最重要的是——至少从系统性风险的角度来看——这些激励比对传统债券共同基金更好。对于ETF,退出的投资者会受到惩罚(他们以折扣市场价格而不是NAV出售)。对于债券基金,留下的投资者会受到惩罚(因为他们通常被困在一个更无价值的、流动性较差的工具中)。

One deters investor runs, the other encourages them. The clear corollary is that ETFs may actually be the better structure for less liquid asset classes like bonds, which goes against what many people have been arguing over the past decade (including me, at least before 2020).

一个阻止投资者抛售,另一个鼓励投资者抛售。一个明显的推论是,对于债券等流动性较差的资产类别而言,ETF实际上可能是更好的结构,这与许多人在过去十年所持的论点背道而驰(包括我在内,至少在2020年之前)。

As Helmke writes:

正如赫尔姆克写道:

. . . ETFs’ market-based pricing mechanism gives rise to reverse run incentives, as strategic substitutabilities encourage shareholders to remain invested when intermediaries are balance sheet constrained. Investors who do not need immediate access to liquidity will always abstain from selling their ETF shares prematurely. The opposite is true for MFs. The insufficient flexibility of MF prices leads to payoff complementarities, encouraging early redemptions by long-term investors during periods of market illiquidity, potentially culminating in mutual fund runs.

. . . ETF基于市场的定价机制产生了反向操作激励,因为当中介机构受到资产负债表限制时,战略可替代性会鼓励股东继续投资。不需要立即获得流动性的投资者总是会避免过早卖出ETF股票。而MF则恰恰相反。MF价格的灵活性不足导致了回报互补,鼓励长期投资者在市场流动性不足时提前赎回,最终可能导致共同基金挤兑。

A lot of people will howl that only the Federal Reserve’s remarkably aggressive interventions — including a vow to buy corporate bond ETFs — helped prevent a far worse disaster for ETFs.

很多人会哀叹,只有美联储非常积极的干预措施——包括承诺购买公司债券ETF——才能帮助ETF避免遭遇更严重的灾难。

And sure, yes, if the Fed had just sat on its hands then things would have been far worse. But we were closer to mass gating across the bond mutual fund complex than we were to a serious bond ETF accident.

当然,如果美联储袖手旁观,情况会更糟。但是,与严重的债券ETF事故相比,我们更接近于在整个债券共同基金复合体的大规模止赎。

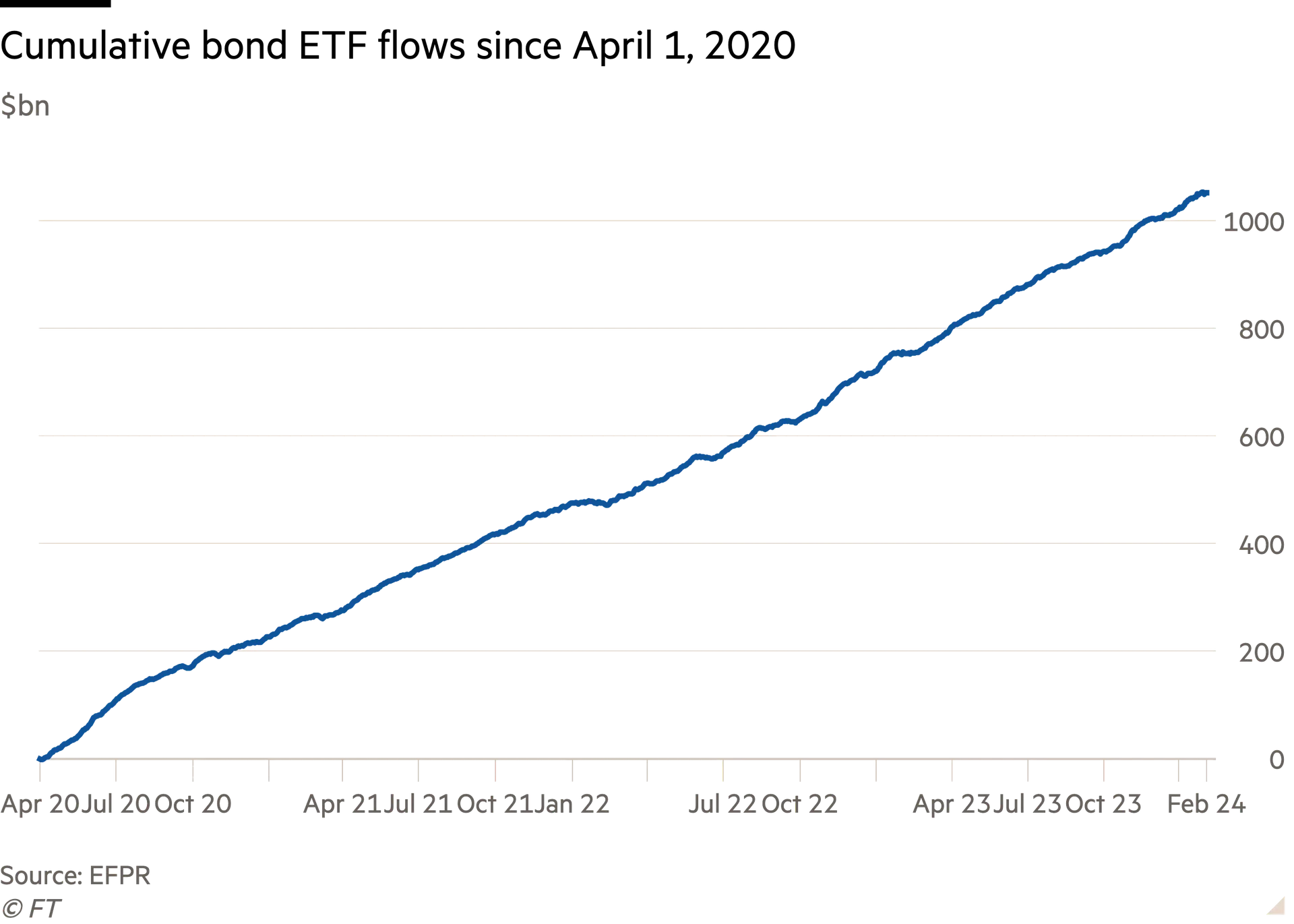

这就是为什么尽管出现了几个世纪以来最大的固定收益熊市之一,债券ETF自2020年4月以来的净流入仍超过1万亿美元。

The downsides of end-of-day NAV redemptions for mutual funds are also why the SEC in 2022 proposed to introduce swing pricing to mutual funds, which would pass on the transaction costs of redemptions to exiting investors As chair Gary Gensler said at the time:

日终资产净值赎回对于共同基金的弊端也是美国证交会(SEC)在2022年提议为共同基金引入摇摆定价的原因,该定价机制将赎回的交易成本转嫁给退出的投资者。正如其主席加里•根斯勒(Gary Gensler)当时所说:

A defining feature of open-end funds is the ability for shareholders to redeem their shares daily, in both normal times and times of stress. Open-end funds, though, have an underlying structural liquidity mismatch. This can raise issues for investor protection, our capital markets, and the broader economy. We saw such systemic issues during the onset of the COVID-19 pandemic, when many investors sought to redeem their investments from open-end funds. Today’s proposal addresses these investor protection and resiliency challenges.

开放式基金的一个决定性特征是股东能够在正常时期和压力时期每天赎回股票。然而,开放式基金存在潜在的结构性流动性错配。这可能会给投资者保护、我们的资本市场和更广泛的经济带来问题。在新冠疫情爆发期间,我们看到了这样的系统性问题,当时许多投资者试图从开放式基金赎回投资。今天的提议解决了这些投资者保护和恢复能力方面的挑战。

Swing pricing was

shouted down by the asset management industry last year.

去年,资产管理行业对摆动定价大加挞伐。