尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

For years, Elon Musk has been the not-so-secret weapon behind Tesla’s success. His reputation as an indefatigable tech maverick helped to make emission-free vehicles desirable, first for the Silicon Valley crowd then the world. Now, his caustic online presence is considered a liability. But he cannot shoulder all the blame for the carmaker’s problems.

多年来,埃隆•马斯克(Elon Musk)一直是特斯拉(Tesla)成功的并不秘密的武器。他作为一个不知疲倦的技术狂人的名声,使零排放车辆受到追捧——首先是硅谷人,然后是全世界。现在,他在网络上的毒舌形象被认为是一个负担。但他不能为这家汽车制造商的问题承担全部责任。

Tesla on Tuesday announced vehicle deliveries in the first quarter had fallen 8.5 per cent on last year, the first year-on-year drop since early 2020. The shares dropped 5 per cent. They are down nearly 60 per cent from its late-2021 high point.

特斯拉周二宣布,第一季度的车辆交付量同比下降了8.5%,这是自2020年初以来的首次同比下降。该公司股价当日下跌5%,而且已从2021年底的高点下跌了近60%。

Tesla blames supply problems, pointing to conflict in the Middle East and an arson attack at its Berlin factory. But a gap between production and delivery numbers suggests issues with demand.

特斯拉将供应问题归咎于中东冲突和柏林工厂的纵火袭击。但是生产和交付数量之间的差距表明存在需求问题。

Musk’s polarising personality may put some customers off. But multiple research companies have come to the same conclusion in previous years, even as delivery numbers rose. In 2021, Escalent wrote he was a drawback for the brand. Last year, Tesla reported record deliveries, topping 1.8mn vehicles.

马斯克极具争议的个性可能会劝退一些顾客。但是即使交付数量在过去几年不断增加,多家研究公司仍得出了相同的结论。在2021年,Escalent写道,他对该品牌是一个不利因素。去年,特斯拉报告了超过180万辆车的创纪录交付量。

The real problem is slowing rates of EV adoption. The stock is priced for nonstop growth. That requires a large customer base, hence Tesla’s transition from high-end, six-figure vehicles to more affordable models and deals with Uber and Hertz. It is targeting a pool of buyers who are more interested in price, range and charging station access than DeLorean style doors and the promise of autonomous driving software.

真正的问题是电动汽车采用率的放缓。股票的定价要基于不间断的增长。这需要庞大的客户群体,因此特斯拉从高端的六位数车型转向更实惠的车型,并与优步(Uber)和赫兹(Hertz)达成交易。它的目标是针对那些更关注价格、续航里程和充电站可及性的买家,而不是德罗宁式(DeLorean)车门和自动驾驶软件的承诺。

EVs are still more expensive to make than petrol cars, partly because of the high cost of minerals required for their batteries. Some of the government subsidies that bridged the gap have been withdrawn. Meanwhile, global price wars are hurting all combatants. Tesla cut prices by up to 20 per cent last year amid a proliferation of low-cost vehicles from China.

电动汽车的制造成本仍然比汽油车高,部分原因是电池所需的矿产成本高昂。一些弥合差距的政府补贴已被取消。与此同时,全球价格战正在伤害所有参与者。在去年中国低成本车型大量涌入市场的背景下,特斯拉降价高达20%。

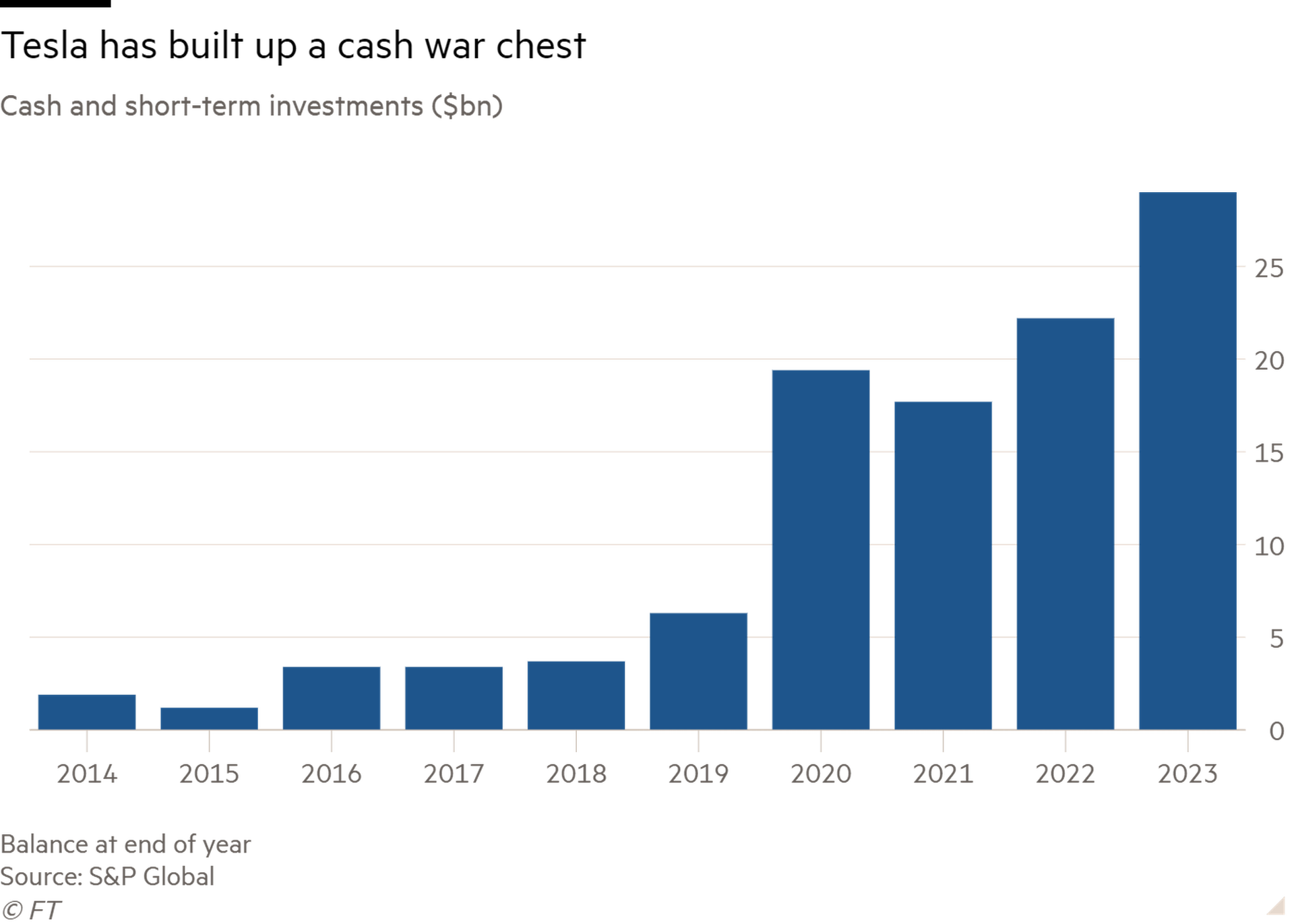

The good news is profitability and high share prices have allowed Tesla to bank funds. At the end of last year it was sitting on more than $29bn in cash and cash equivalents, up from less than $4bn five years earlier. It has the means to see off low-priced competitors while working on charging infrastructure and more affordable vehicles.

好消息是,盈利能力和高股价使特斯拉能够积累资金。去年底,其现金及现金等价物超过290亿美元,而五年前才不到40亿美元。特斯拉有能力抵御低价竞争对手,同时致力于充电基础设施和更实惠车型的研发。

Musk’s plans are as bombastic as ever. On the realistic end is a $25,000 vehicle and cheaper assembly process. But one day, he says, Tesla and SpaceX may create something that is not “even really a car”. The Technoking is the reason Tesla remains the most distinctive car company in the world.

马斯克的计划一如既往地夸张。现实的计划是每辆车2.5万美元的售价和更便宜的组装过程。但他说,特斯拉和SpaceX可能会创造出一些甚至不是“真正的汽车”的东西。这位“技术之王”(Technoking,又译“电音之王”,马斯克自创头衔——译者注)是特斯拉仍然是世界上最独特的汽车公司的原因。